Learn how to trade forex with just $100 in 2023 using high leverage. Explore the benefits and dangers of trading with brokers like HYCM, XM, Pocket Option, and BlackBull.

Trading in the forex market with a limited budget is not only possible but can also be a rewarding venture. In this guide, we will walk you through the process of trading forex with as little as $100 while utilizing the power of leverage. We will delve into the concept of forex, explain leverage, highlight the advantages of trading with high leverage, and provide insights into the potential risks.

Risk Warning:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Estimated 90% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is Forex Trading?

Forex, or foreign exchange, refers to the global market where currencies are bought and sold. Traders aim to profit from the fluctuations in exchange rates between different currency pairs. The forex market operates 24/5, making it accessible and dynamic for traders worldwide.

Understanding Leverage

Leverage allows traders to control a larger position size with a smaller amount of capital. For instance, with 1:1000 leverage, you can control a position worth $100,000 with only $100. While leverage amplifies potential gains, it also magnifies potential losses.

Benefits of High Leverage

Brokers like HYCM, XM, Pocket Option, and BlackBull offer high leverage, which can be advantageous for traders with limited capital:

- Small Investment, Big Exposure: With as little as $100, you can access larger trading positions, increasing profit potential.

- Diversification: Higher leverage enables you to diversify your trades and explore various currency pairs or assets.

- Low Barrier to Entry: Brokers like XM and Pocket Option require minimal deposits, making forex trading accessible to everyone.

Trading with High Leverage: Caution and Strategy

While high leverage offers opportunities, it comes with risks:

- Risk of Loss: The same leverage that magnifies gains can also lead to significant losses. Risk management strategies are crucial.

- Volatility Impact: Forex markets can be highly volatile. Leveraged trades can be affected by even small market movements.

- Overtrading: High leverage might encourage overtrading, leading to impulsive decisions and losses.

Notable Brokers with Low Deposits and High Leverage

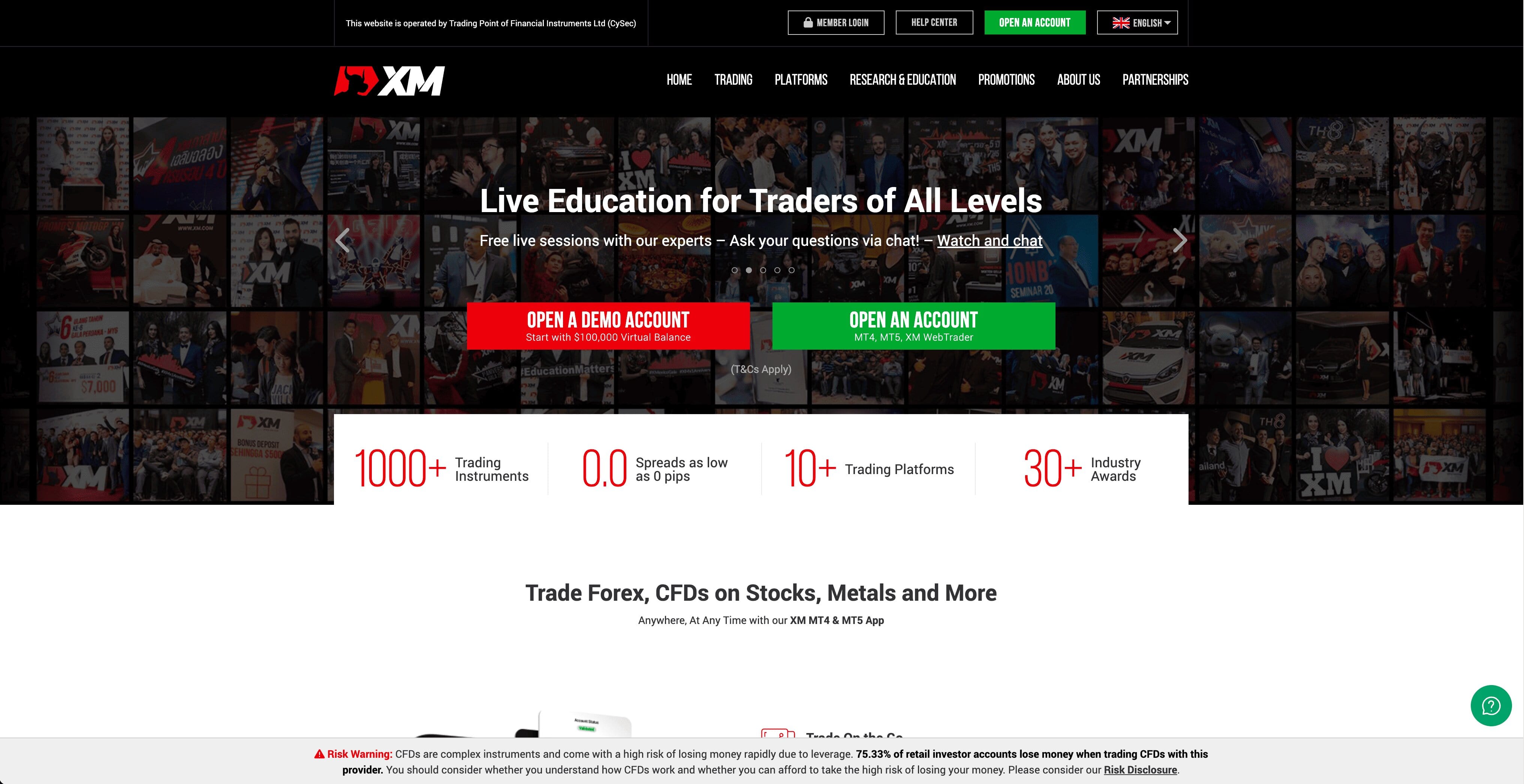

- XM: Minimum deposit $5, leverage up to 1:1000.

- Pocket Option: Minimum deposit $50, leverage up to 1:1000.

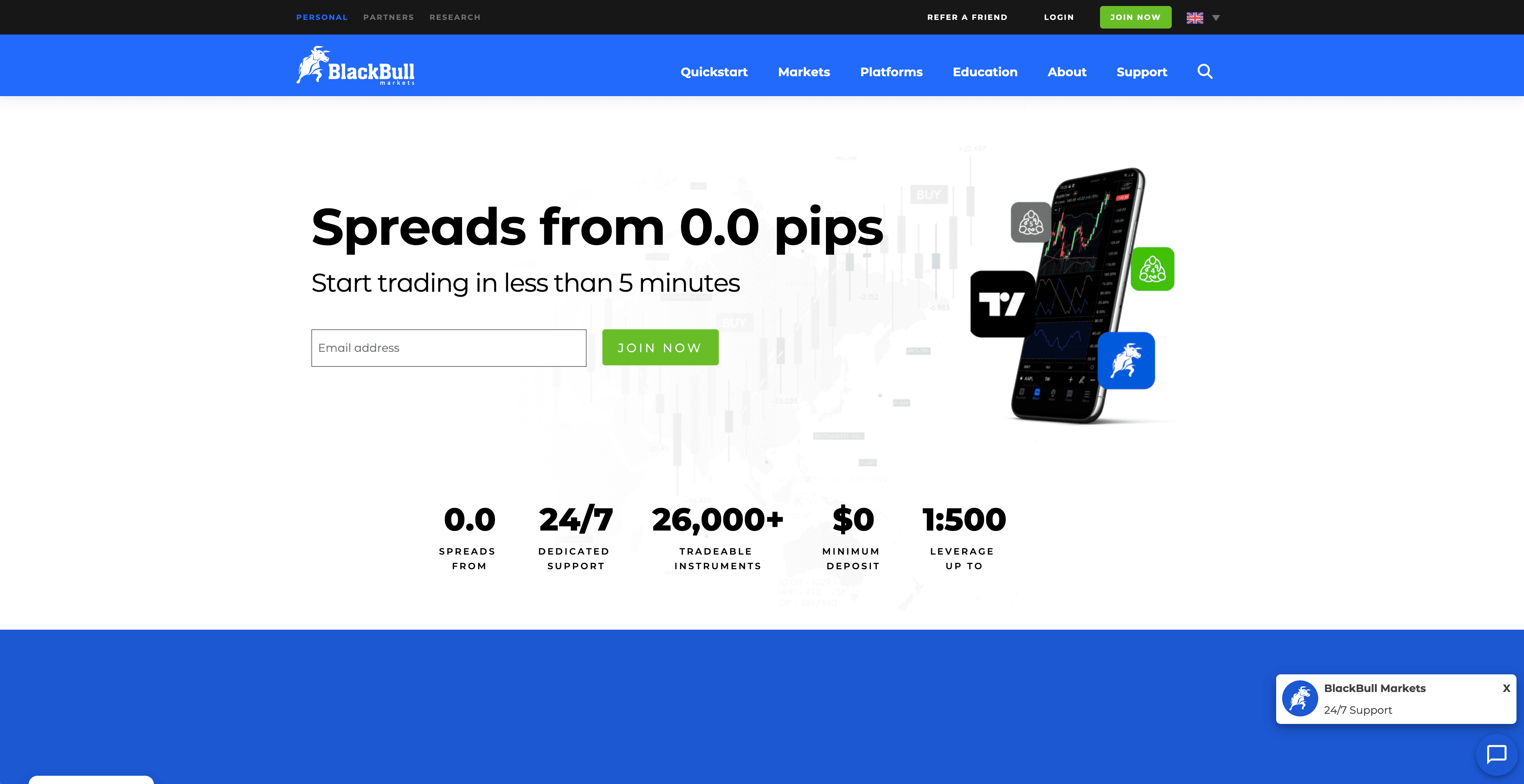

- BlackBull: No minimum deposit, leverage up to 1:500.

- HYCM: Minimum deposit $100, leverage up to 1:500.

FOREX FAQ's

1. What is Forex?

Forex, or foreign exchange, is the global market where currencies are traded.

2. What is Leverage in Forex Trading?

Leverage allows traders to control larger positions with a smaller amount of capital.

3. Why Choose High Leverage Brokers?

High leverage brokers enable traders to access larger positions with minimal capital, potentially magnifying profits.

4. What Are the Risks of High Leverage?

High leverage also magnifies potential losses, so risk management is crucial.

Similar topics

Unbiased Reviews and Expert Insights. We've Tested and Traded on Various Brokers, Analyzing Trading, Forex, Stocks, Leverage, and Commissions. Find Your Ideal Broker in for Successful Trading!

Updated July 29th, 2023 10:44:49AM

BDswiss is an established and regulated online trading platform that has been serving global traders since 2012. It operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC) and adheres to strict regulatory standards, ensuring a safe and reliable trading environment. BDswiss offers a comprehensive suite of trading services, catering to the diverse needs of Australian investors.

Updated July 31st, 2023 09:53:37AM