Investment Ideas from 30 Million Users and Invest in 3000+ Assets on a Reliable and User-Friendly Platform.

Discover the Top Forex Brokers in Europe 2023:

Discover the best forex brokers in Europe for 2023, offering top trading platforms for forex, indices, and stocks. Our unbiased reviews and expert insights rank these brokers based on trading conditions, leverage, commissions, and customer support. Elevate your trading experience with the leading platforms, catering to traders of all levels. Forex trading carries risks, so educate yourself and choose a reputable broker with transparent pricing and favorable trading conditions. Find your ideal broker and navigate the financial markets with confidence in 2023.

Risk Warning:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Estimated 90% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

5 BEST FOREX BROKERS

Are you ready to embark on an extraordinary trading journey? Look no further than our handpicked selection of the 9 best forex brokers. These leading platforms offer a thrilling and secure trading environment, powered by cutting-edge technologies. Whether you're a seasoned trader or a beginner, these brokers cater to your needs.

Immerse yourself in a world of endless opportunities and enjoy the convenience of trading with the best forex brokers in Europe. Our expert team has meticulously reviewed and ranked these brokers based on factors like trading conditions, leverage, commissions, and customer support. Join us as we unveil the ultimate destinations for forex trading enthusiasts. Get ready to elevate your trading experience to new heights!

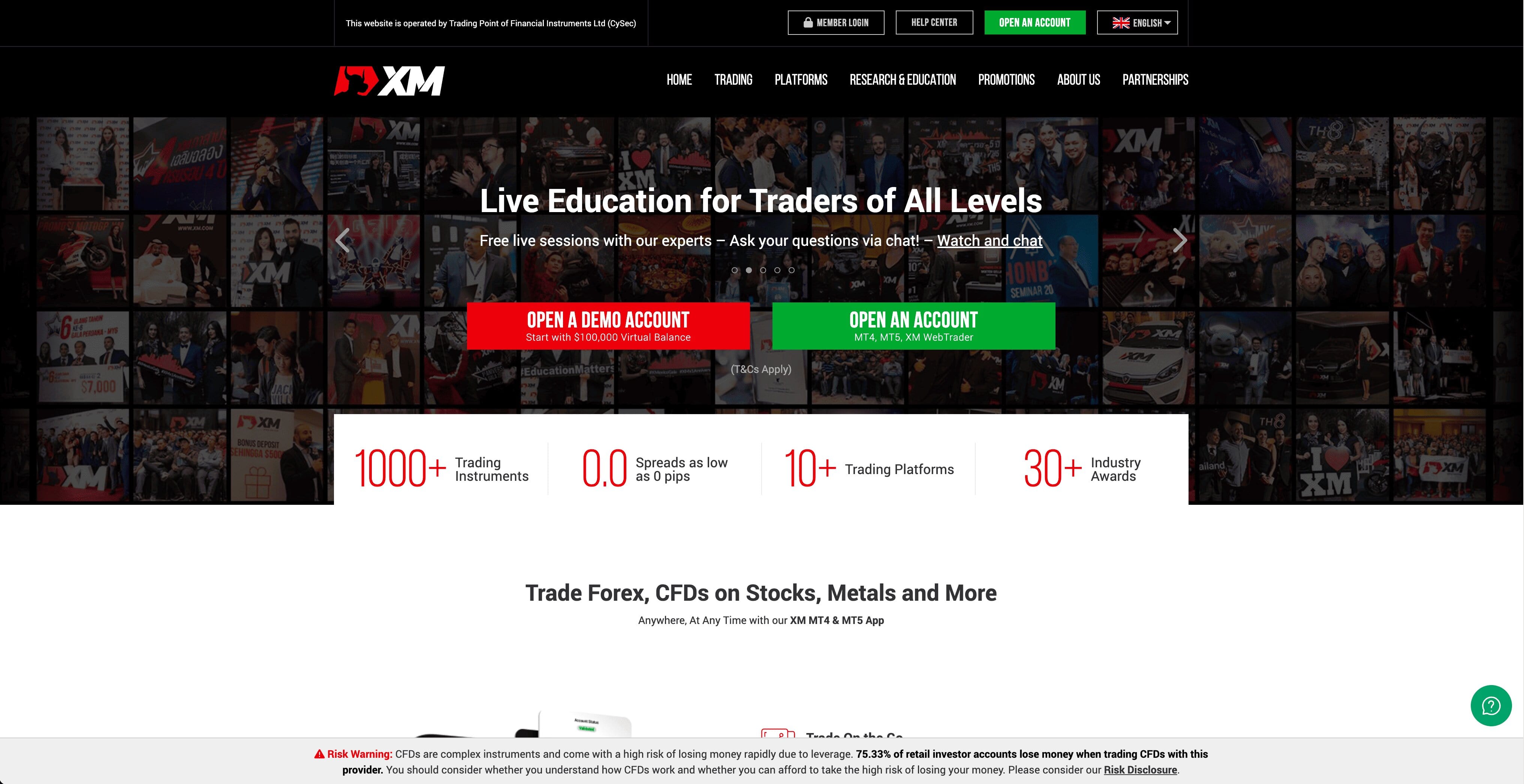

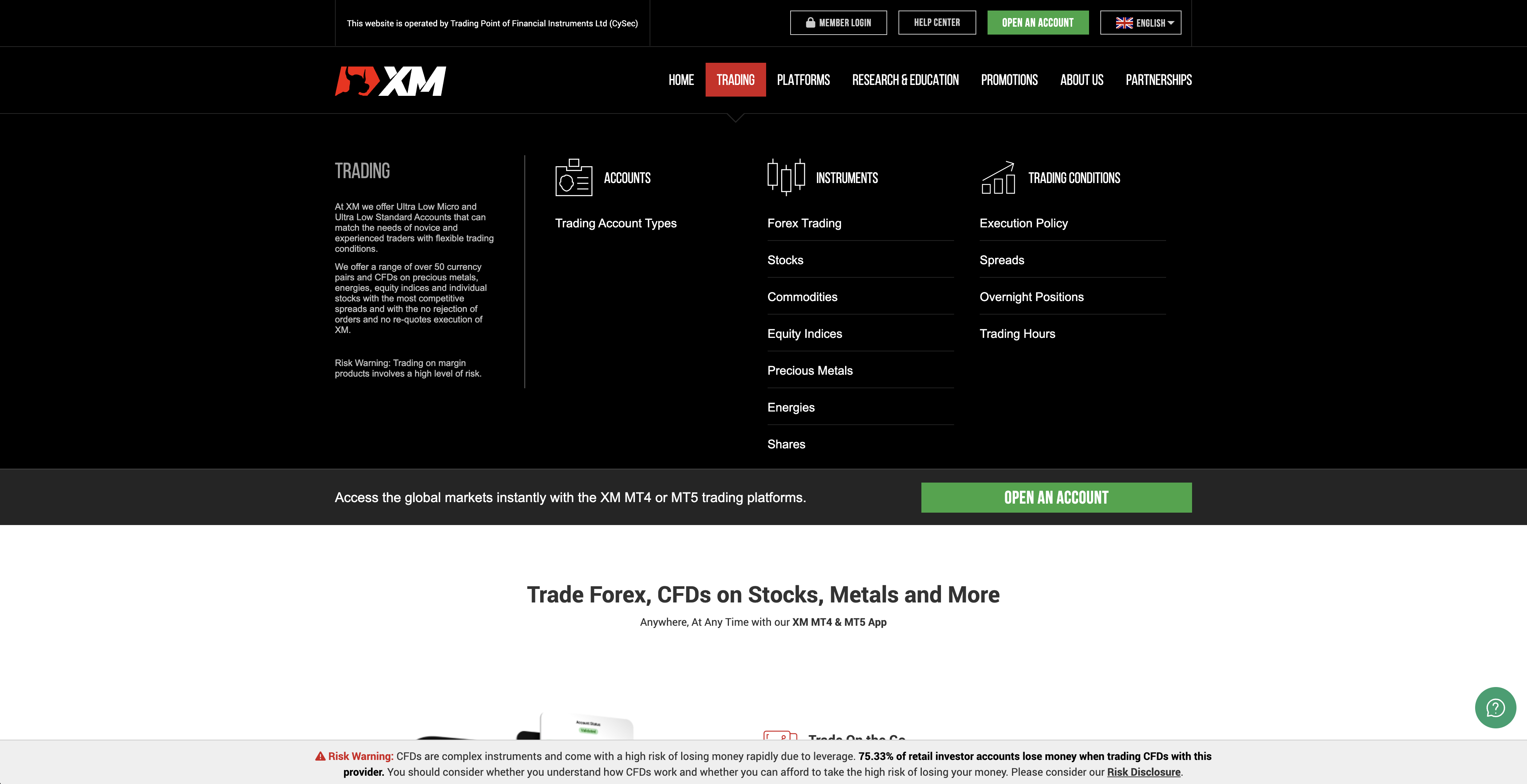

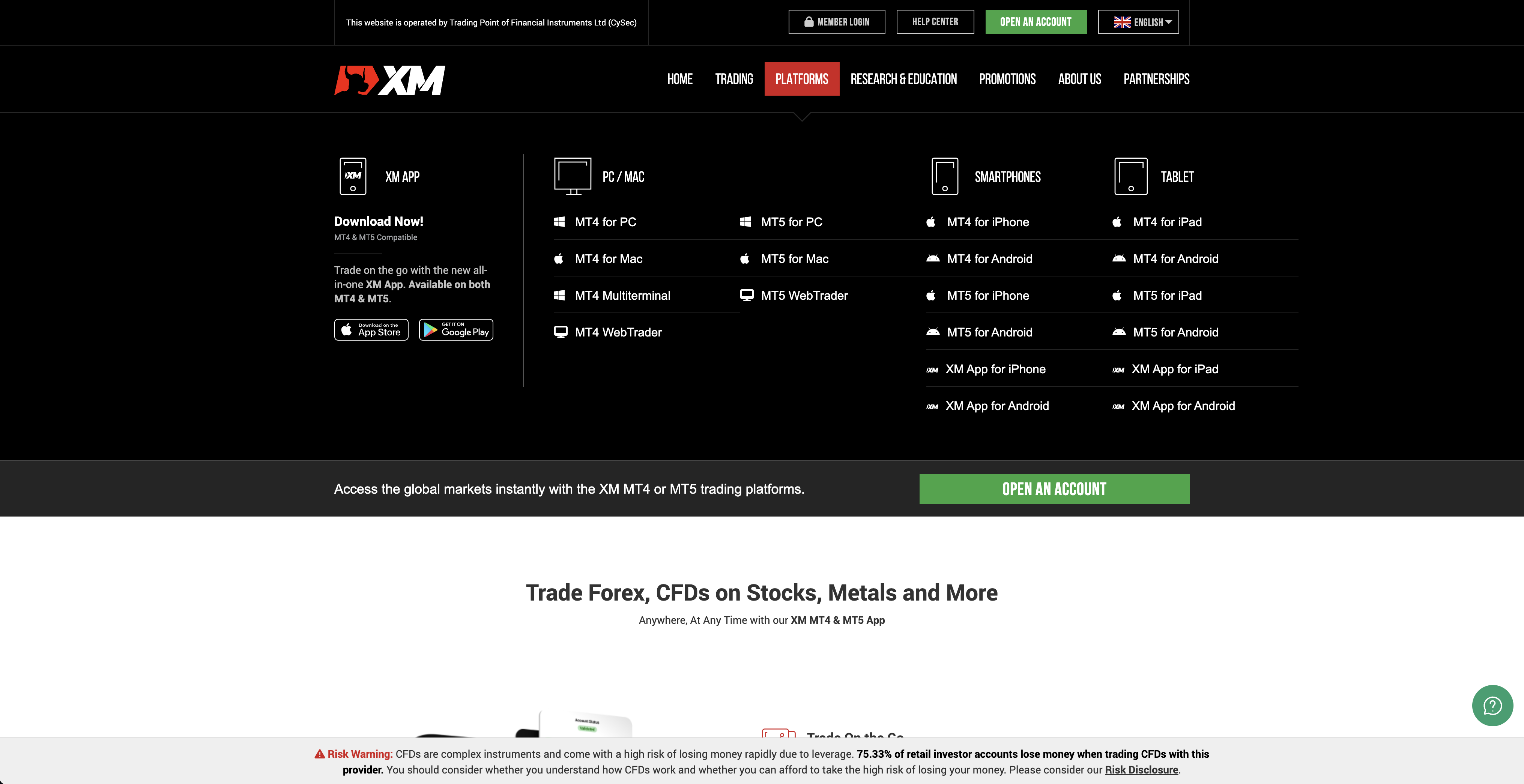

1. XM

Our rating: 9.5/10

Welcome to the world of exceptional trading experiences with XM Group! As a distinguished MetaTrader specialist, XM Group stands as a leading name in the forex industry, offering a diverse range of CFDs and forex pairs for traders worldwide. Our comprehensive review reveals the unmatched educational content and market research, empowering traders with valuable insights. Join us on a journey of transparency, innovation, and reliability as we delve into the outstanding features that make XM Group a top choice for both novice and seasoned traders alike.

Pros

- Offers 1,429 CFDs, including 55 forex pairs.

- Trading Central's tools complement XM Group's in-house research.

- Excellent research content, including videos, podcasts, and articles.

- A comprehensive selection of educational webinars and courses.

- XM Shares account offers exchange-traded securities (non-CFD).

- Uses the full MetaTrader suite with signals market and Analyzzer algorithm.

- Provides guaranteed fills for market, stop-loss, and limit orders up to 50 lots (5 million units of currency).

- Over 10 million clients serviced since 2009, executing 2.4 billion trades.

Cons

- Standard account spreads are expensive compared to industry leaders.

- Average spreads for the XM Zero account are not published.

- No proprietary trading platforms offered; only MetaTrader suite.

About XM

a Big, Established, and Experienced player in the financial industry. Founded in 2009, XM has successfully served over 10,000,000 clients, earning a reputation as a true industry leader.

Comprising a team of over 900 financial professionals with extensive expertise, XM Group's global reach spans well over 30 languages. This diversity and wealth of knowledge make XM the preferred broker for traders of all levels worldwide. As a leading investment firm, XM Group is committed to assisting traders in achieving their investment goals, thanks to its vast resources and experience in the field.

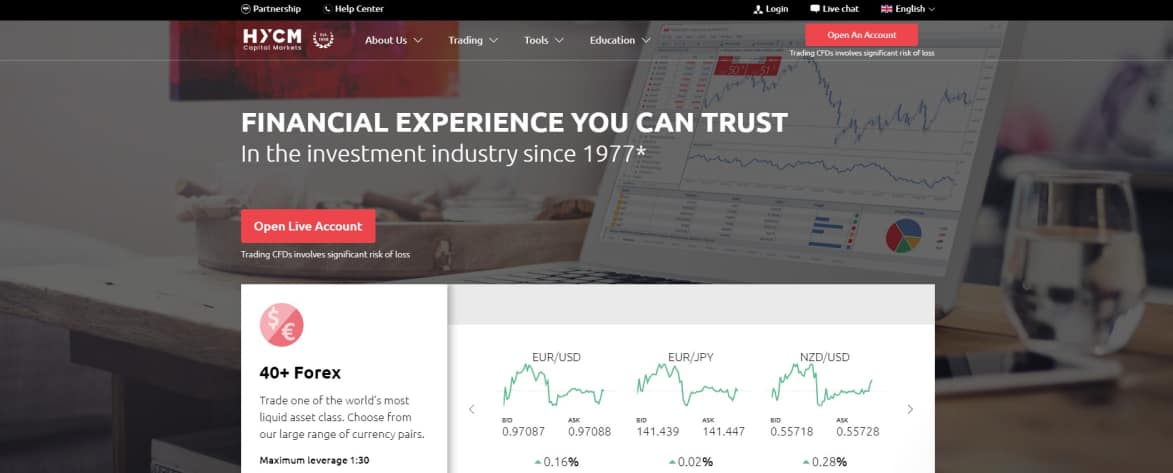

2. HYCM Capital Markets

Our rating: 9.4/10

Discover the in-depth analysis of HYCM, a well-respected brand in the financial industry. This review, written by Steven Hatzakis, edited by John Bringans, and fact-checked by Blain Reinkensmeyer, provides a comprehensive look at HYCM's features, offerings, and overall trading experience.

Pros

- Benefit from the full trading capabilities of the HYCM Trader mobile app.

- Access more than 20 video courses from MTE-Media, catering to different experience levels.

- The platform offers third-party research modules from Trading Central, including Analyst Views and an Economic Calendar.

- Users also receive streaming forex news headlines through the MetaTrader platform suite.

- XM Shares account offers exchange-traded securities (non-CFD).

- Non-CFD exchange-traded securities are available through the separate Henyep Securities platform.

Cons

- Cryptocurrency CFDs are limited to offshore entities, specifically the Cayman Islands and SVG.

- While the educational content has improved, it remains comparatively limited compared to other top brokers in the industry.

- Research offerings still fall behind industry leaders.

About HYCM Capital Markets

HYCM is a reputable broker with a Trust Score of 88, providing access to 1199 tradeable symbols and competitive pricing. Its Raw account boasts a competitive all-in cost of about 0.6 pips for the EUR/USD after commission. Despite some limitations, HYCM stands as a trusted option for traders seeking a reliable platform.

3. BlackBull Markets

Our rating: 9.4/10

Explore the comprehensive review of BlackBull Markets, a dynamic broker offering the complete MetaTrader suite (MetaTrader 4 and MetaTrader 5). Alongside multiple social copy trading platforms and a web app powered by TradingView, BlackBull Markets delivers a diverse trading experience.

Pros

- Traders can utilize both MetaTrader 4 and MetaTrader 5 platforms.

- Benefit from third-party trading tools from Autochartist and Acuity.

- The broker supports multiple copy trading platforms, including ZuluTrade, Duplitrade, and Myfxbook.

- Integration with the TradingView web platform was introduced in 2021.

- The recently launched BlackBull CopyTrader web platform enhances its social copy trading offering.

- Notably, the broker received a substantial private equity investment, affirming its position as a leading New Zealand broker.

Cons

- BlackBull Markets lacks additional Tier-1 regulatory licenses outside New Zealand.

- The Seychelles-licensed entity offers light regulatory protection.

- Educational content may be limited compared to top MetaTrader brokers.

- Integration with the TradingView web platform was introduced in 2021.

- Commissions and fees appear to align with the industry average based on average spreads.

About Blackbull Markets

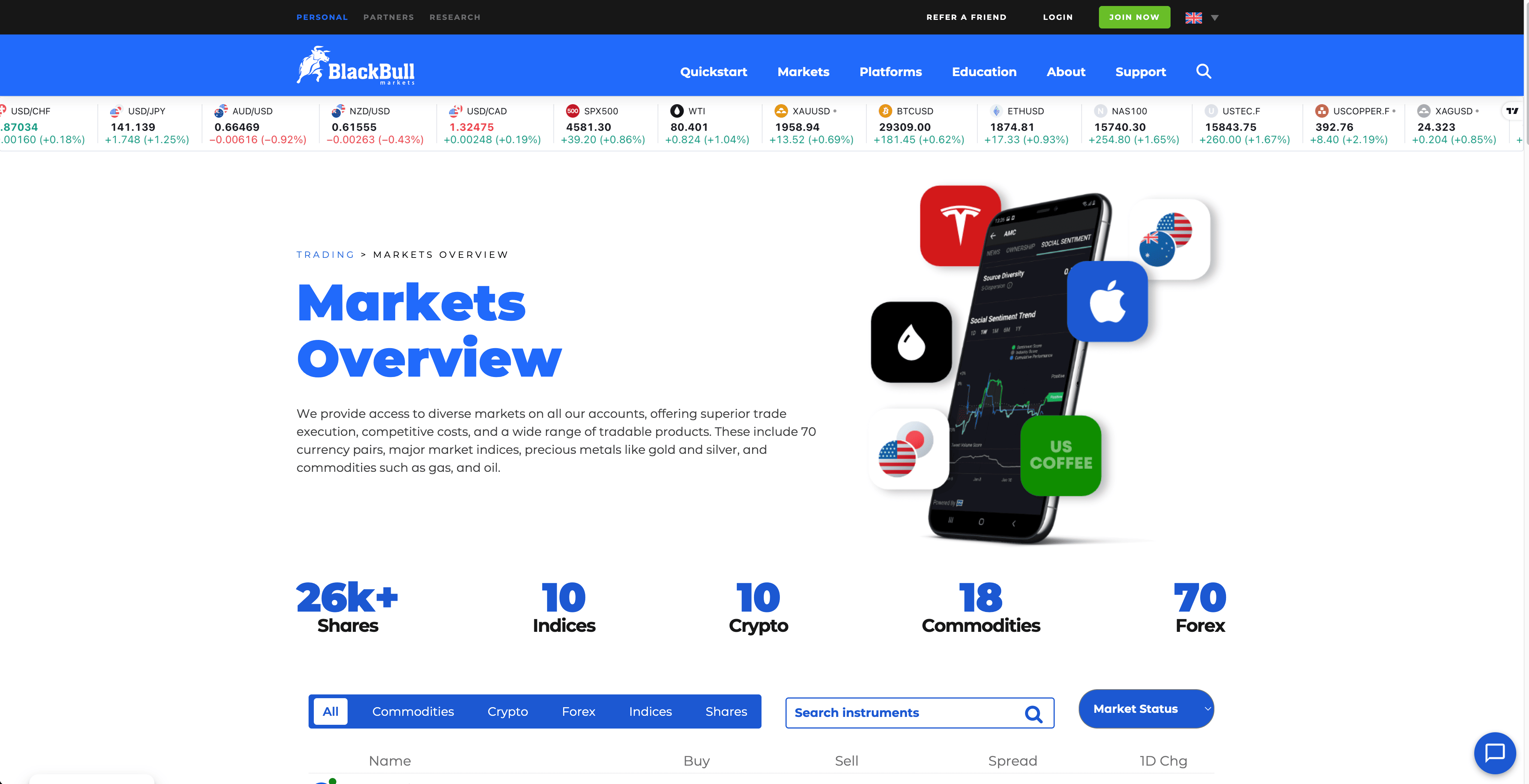

In 2014, BlackBull Markets emerged in Auckland, New Zealand, as the brainchild of Michael Walker and Selwyn Loekman. Over the years, the company has garnered the trust of traders from 180+ countries, becoming a leading and regulated ECN broker. Today, BlackBull Markets provides a diverse range of over 26,000 tradable instruments, encompassing stocks, forex, CFDs, and commodities, making it a reliable and sought-after platform for tens of thousands of traders worldwide.

4. Pocket Option

Our rating: 9.1/10

Getting started with Pocket Option is a breeze. Upon reaching the homepage, you can quickly sign up for an account, either by creating a new username and password or using your existing Facebook or Google account. After a straightforward signup process, you become a "member" of the site.

Pros

- User-Friendly Interface: Pocket Option offers a user-friendly interface that is easy to navigate, making it suitable for both beginners and experienced traders.

- Virtual Trading: The platform allows users to practice and gain experience in binary trading using virtual (fake) money, providing a risk-free environment for learning.

- Low Minimum Deposit: Pocket Option offers a minimum deposit of only $50, making it accessible to traders with limited funds.

- Wide Range of Deposit Methods: The platform supports multiple deposit methods, including cryptocurrencies, debit and credit cards, and bank connections, providing flexibility for funding accounts.

- Real-Time Interactive Charts: Pocket Option provides real-time interactive charts with comprehensive data on stocks, currencies, indices, and commodities, empowering traders to make informed decisions.

- Multiple Trading Assets: Users can choose from a variety of trading assets, offering diverse trading opportunities.

Cons

- Risky Nature of Binary Options: Binary options trading involves a high level of risk, and if the trader's prediction is incorrect, they may lose the entire amount invested.

- Limited Educational Resources: Pocket Option's educational resources and research materials are relatively sparse compared to some other platforms, which may not be ideal for traders seeking extensive learning opportunities.

- Lack of Additional Regulatory Licenses: The platform lacks additional Tier-1 regulatory licenses outside of New Zealand, potentially raising concerns for traders looking for enhanced regulatory protection.

- Limited Trading Platforms: While Pocket Option offers MetaTrader 4 and MetaTrader 5, some traders may miss access to other proprietary trading platforms.

- Seychelles-Licensed Entity: The regulatory protection offered by the Seychelles-licensed entity of Pocket Option may be considered lighter than the Tier-1 regulation provided in other jurisdictions.

About Pocket Option

Pocket Option was founded in 2017 by a group of Financial Tech and IT specialists with a mission to create an online trading platform specifically designed for the binary options market. Their goal was to make the interface highly convenient, user-friendly, and even "fun" to use, setting it apart from typical brokerage platforms.

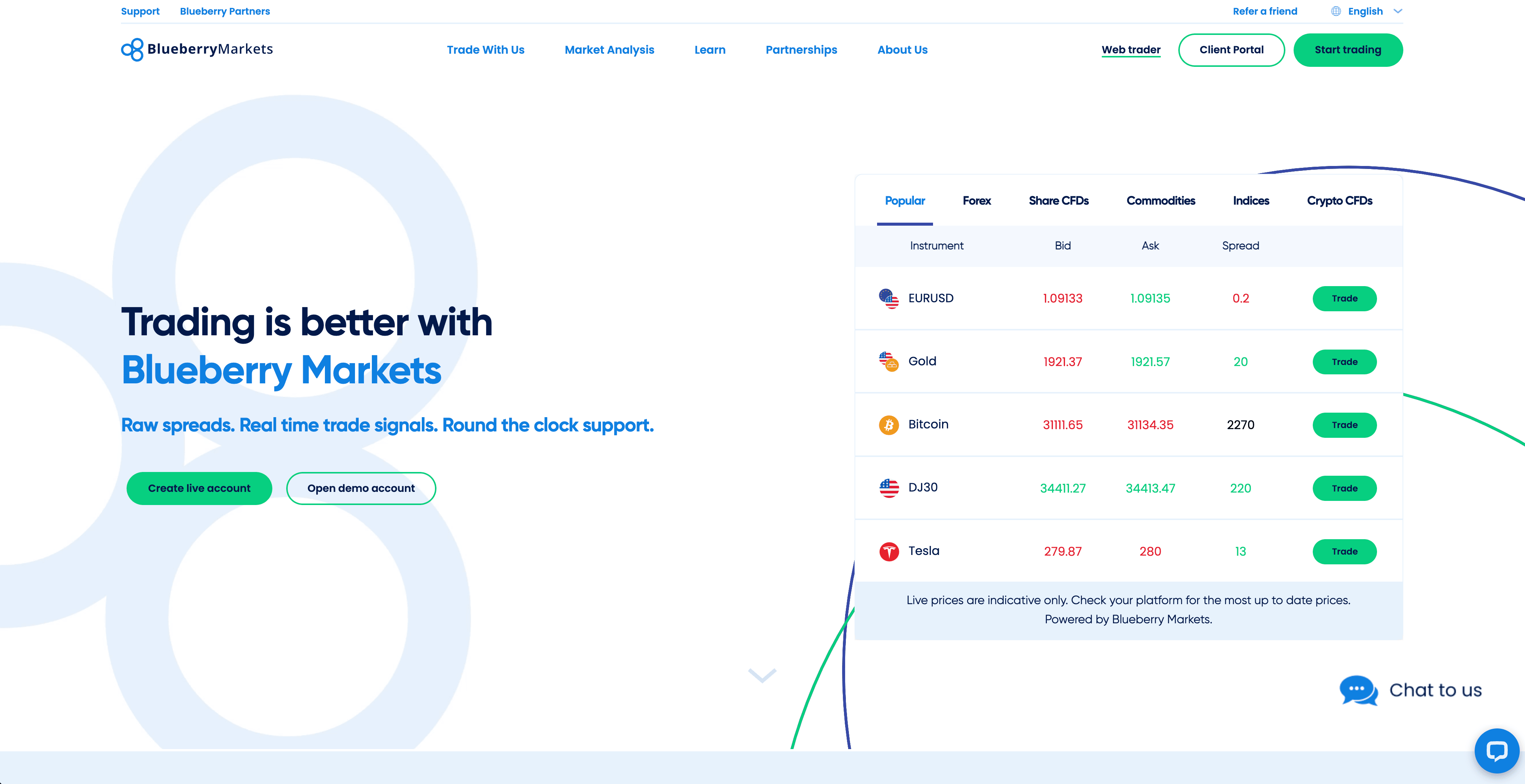

5. Blueberry Markets

Our rating: 9.1/10

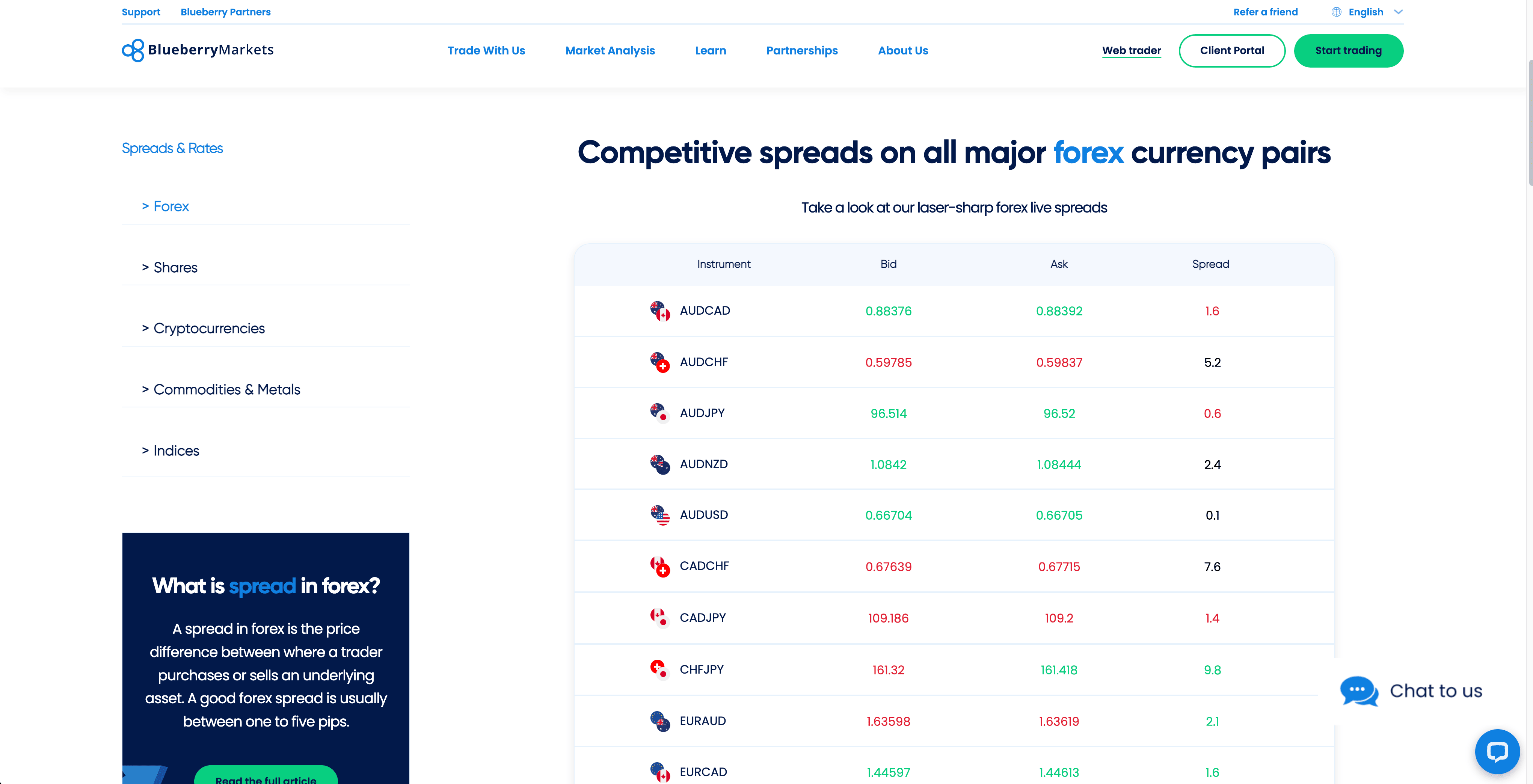

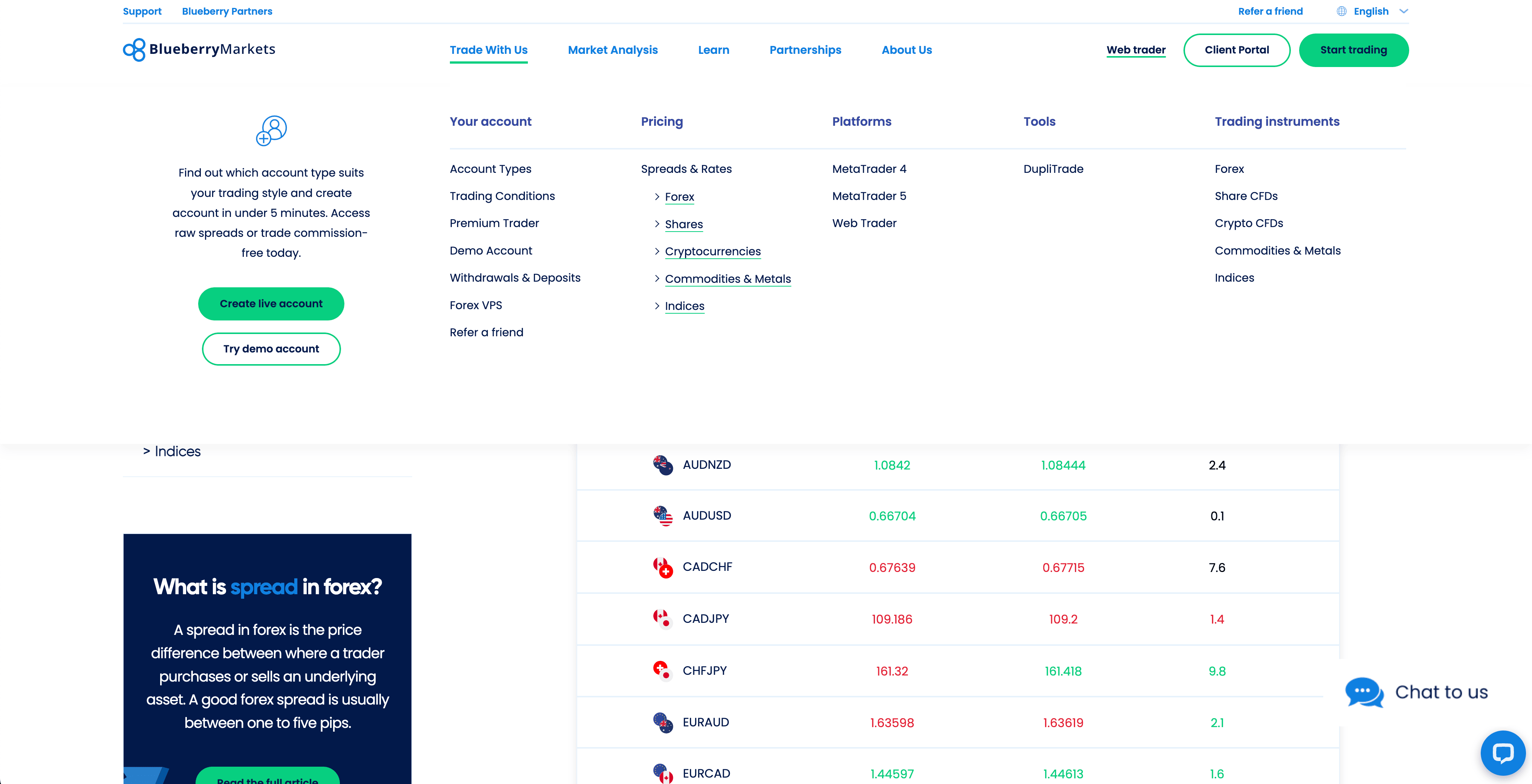

Blueberry Markets is a regulated and reputable Forex and CFD broker, providing traders worldwide with access to the financial and currency markets since 2016. With representative offices in Australia and Vanuatu, the company operates under the watchful eye of ASIC (Australian Securities and Investments Commission) and VFSC (Vanuatu Financial Services Commission), ensuring a secure trading environment for its clients. Blueberry Markets offers a diverse range of financial instruments, including currency pairs, commodities, cryptocurrencies, stocks, and indices, making it suitable for both active traders and passive investors. Traders can utilize MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, access copy trading options, and benefit from advanced analytics and training resources.

Pros

- Regulation: Blueberry Markets is regulated in two jurisdictions, providing clients with an added layer of trust and security.

- Diverse Asset Selection: Traders have access to a wide range of financial instruments, allowing them to implement various trading strategies.

- Competitive Spreads: Accounts with a fee per lot offer the possibility of trading with minimal spreads.

- Free Forecasts: Blueberry Markets provides free forecasts for Forex and popular CFD types, assisting traders in making informed decisions.

- Generous Leverage: The broker offers leverage of up to 1:500, providing traders with enhanced trading potential.

- Flexible Trading Techniques: Blueberry Markets allows the use of various trading techniques, copy trading, and expert advisors without restrictions.

Cons

- Regulation: Blueberry Markets is regulated in two jurisdictions, providing clients with an added layer of trust and security.

- Diverse Asset Selection: Traders have access to a wide range of financial instruments, allowing them to implement various trading strategies.

- Competitive Spreads: Accounts with a fee per lot offer the possibility of trading with minimal spreads.

- Free Forecasts: Blueberry Markets provides free forecasts for Forex and popular CFD types, assisting traders in making informed decisions.

- Generous Leverage: The broker offers leverage of up to 1:500, providing traders with enhanced trading potential.

- Flexible Trading Techniques: Blueberry Markets allows the use of various trading techniques, copy trading, and expert advisors without restrictions.

About Blueberry Markets

Blueberry Markets is committed to providing a transparent and reliable trading experience to its clients. Its regulation in two jurisdictions, along with publicly-available audit reports, ensures a trustworthy trading environment. With a focus on customer service and a diverse range of financial instruments, Blueberry Markets caters to traders of varying experience levels. However, potential clients should consider the minimum deposit requirement and lack of standard bonuses before making a decision. Overall, Blueberry Markets stands as a competitive option for traders seeking a regulated and feature-rich broker for their trading journey.

More of our top picks

Investment Ideas from 30 Million Users and Invest in 3000+ Assets on a Reliable and User-Friendly Platform.

BEST FOREX FAQ'S

1. What is Forex?

Forex, short for Foreign Exchange, refers to the global decentralized market where currencies are bought, sold, exchanged, and speculated upon. It is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Forex trading involves pairs of currencies, where one currency is exchanged for another at an agreed-upon exchange rate.

2. How do I Trade Forex?

To trade forex, you'll need to open an account with a reputable forex broker. Once your account is set up, you can access the broker's trading platform, which provides tools and features to execute trades. Traders speculate on the price movements of currency pairs by taking long (buy) or short (sell) positions. Successful trading requires analyzing market trends, using technical and fundamental analysis, and managing risk effectively.

3. What are CFDs (Contracts for Difference)?

CFDs, or Contracts for Difference, are financial derivatives that allow traders to speculate on the price movements of various financial assets without owning the underlying asset. When trading CFDs, you enter into an agreement with the broker to exchange the difference in the asset's price from the contract's opening to closing. It enables traders to profit from both rising and falling markets.

4. What is Leverage in Forex Trading?

Leverage is a borrowing mechanism offered by forex brokers that allows traders to control larger positions with a smaller amount of capital. For example, a leverage ratio of 1:100 means you can control $100 in the market with just $1 of your own capital. While leverage magnifies profits, it also increases potential losses, so it should be used with caution.

5. What is a Stop-Loss Order?

A stop-loss order is a risk management tool used in forex trading to limit potential losses. When you place a stop-loss order, you set a specific price at which your trade will be automatically closed if the market moves against your position. It helps protect your capital and prevents significant losses during adverse market conditions.

6. What are Major Currency Pairs?

Major currency pairs are the most traded and liquid currency pairs in the forex market. They include pairs like EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), USD/JPY (US Dollar/Japanese Yen), and USD/CHF (US Dollar/Swiss Franc). These pairs often have tight spreads and high trading volumes, making them popular choices for traders.

7. What is a Pip?

A pip (percentage in point) is the smallest price move that a given exchange rate can make based on market convention. For most currency pairs, a pip is equal to 0.0001 or 1/100th of one percent. It represents the last decimal point in the exchange rate. Pip movement is essential for calculating profit or loss in forex trading.

8. How Do I Choose the Right Forex Broker?

Choosing the right forex broker is crucial for successful trading. Consider factors such as regulation, trading platform, spreads, commissions, customer support, educational resources, and account types. Look for brokers with a good reputation, transparent pricing, and favorable trading conditions that align with your trading style and goals. Always verify the broker's regulation status before opening an account.

Remember that forex trading carries inherent risks, and it's essential to educate yourself, practice with a demo account, and implement sound risk management strategies to navigate the market effectively.

Similar topics

Unbiased Reviews and Expert Insights. We've Tested and Traded on Various Brokers, Analyzing Trading, Forex, Stocks, Leverage, and Commissions. Find Your Ideal Broker in for Successful Trading!

Updated July 29th, 2023 10:44:49AM

BDswiss is an established and regulated online trading platform that has been serving global traders since 2012. It operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC) and adheres to strict regulatory standards, ensuring a safe and reliable trading environment. BDswiss offers a comprehensive suite of trading services, catering to the diverse needs of Australian investors.

Updated July 31st, 2023 09:53:37AM

Learn how to trade forex with just $100 in 2023 using high leverage. Explore the benefits and dangers of trading with brokers like HYCM, XM, Pocket Option, and BlackBull.

Updated August 12th, 2023 08:46:02AM